Frustrated with forex trades that immediately go against you? You’ve done your research, you understand trends, but you’re still losing. The problem? Your entries.

This guide will teach you how to pinpoint better entry points for more profitable forex trading. But first, two crucial points:

- Direction: Align yourself with the overall market trend. Don’t get caught up in short-term fluctuations. Analyze price charts and fundamental news to determine the dominant direction, and only trade with that direction.

- Objective: What do you hope to achieve with the trade? Are you trying to catch a quick bounce, or ride a long-term trend?

Entries for trading the trend

The goal here is to jump in at the right time to capitalize on a new trend, not necessarily at the perfect price. Look for these entry signals:

- Key Level Rejection: Identify significant support or resistance levels (levels with historical highs/lows or round numbers like 1.20). Watch for price to try to break through, but quickly bounce back.

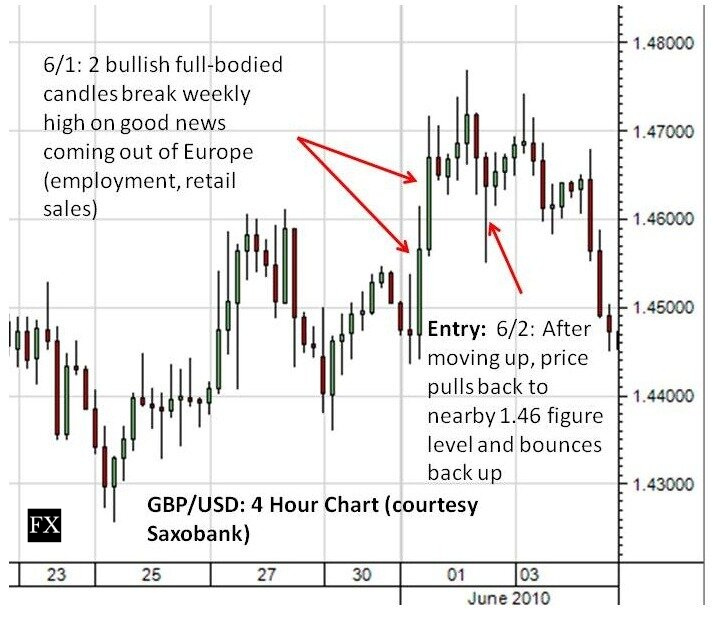

- Confirmation with Strong Candles: After a rejection, look for large, full-bodied candles confirming the reversal, ideally supported by unexpected good economic news.

- Break of Weekly High/Low: Watch for price to break the previous week’s high or low after the strong move.

- Shallow Pullback Entry (10-20%): Don’t wait for a deep “discount.” When price breaks a weekly high/low with strong volume, pullbacks are often small. Traders who wait for a 50-80% pullback often miss the move entirely. Ask yourself: Why wait for a pullback if you are confident in the prevailing trend?

Entries for catching bounces

For quick profits from bounces, a slightly different approach is needed:

- Convincing Break of Weekly Highs/Lows: Look for strong, full-bodied candles breaking weekly highs or lows, indicating strong market conviction, ideally fueled by a market reaction to surprising economic news.

- Retest or Nearby Key Level: After a strong break, wait for price to retest the broken level or a nearby key level. Shallow pullbacks are common after strong moves.

The Bottom Line:

Combine fundamental and technical analysis to identify high-probability trades. Don’t get lost in the noise of random price fluctuations. By focusing on direction, objective, and strategic entries, you can significantly improve your forex trading results.

We hope you have enjoyed this article, for more articles like this, tips for improving your trading, be sure to check our education articles.

Want to trade forex? Here’s a list of forex brokers to check out plus analysis and predictions for major currencies.