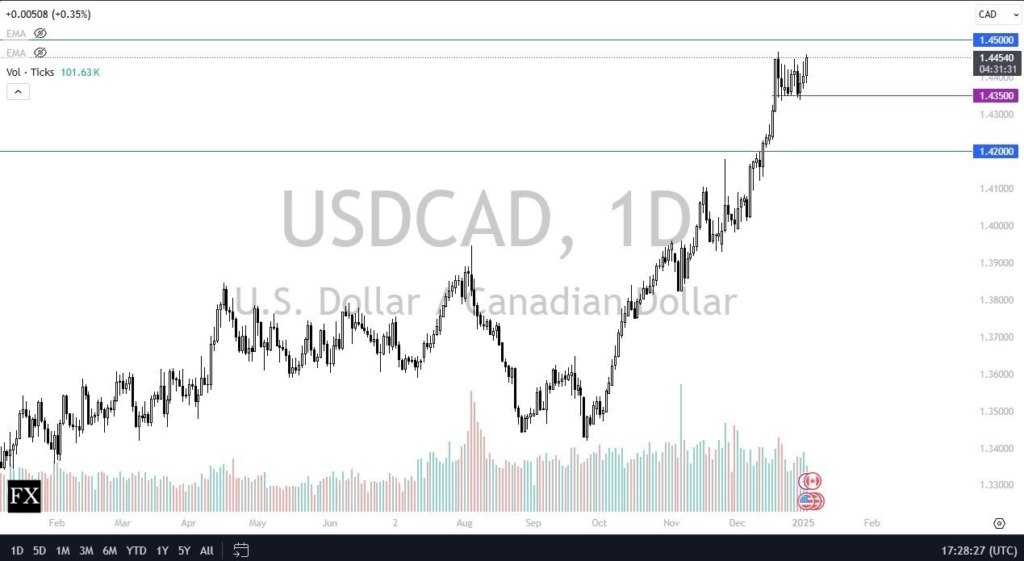

The USD/CAD pair continued its upward trajectory today, as the US dollar gained further ground against the Canadian dollar. This surge has brought the pair to the 1.45 level, which represents a significant historical resistance point. Examination of past price charts reveals that this zone has repeatedly acted as a formidable barrier. While this resistance might tempt retail traders to initiate short positions, such a reaction without further analysis could be premature. The potential for a false breakout or continued upward momentum exists.

While a reversal at the 1.45 resistance is possible, there is currently no clear fundamental justification for such a move. The recent surge, from approximately 1.34 to 1.44, highlights the USD/CAD’s tendency for rapid, substantial price movements. This pair often exhibits periods of relative inactivity followed by sudden, sharp directional shifts, often spanning several hundred pips. Therefore, relying solely on technical resistance may be risky without considering the absence of underlying fundamental drivers.

Canada’s Economic Issues and Their Impact on the CAD

As this trend concludes, the question becomes: what’s next? The challenges facing the Canadian government, while outside the scope of this discussion, contribute to the ongoing weakness of the Canadian dollar. Examining the interest rate yields, we observe a divergence between the US (blue) and Canada (red). Although not the sole indicator, this is a noteworthy trend. Currently, the Canadian 10-year yield stands at 3.2%, while the US yield is 4.56%.

Currently, converting Canadian dollars to US dollars offers a dual benefit: a higher yield and potential currency appreciation. This is a significant market trend. While this chart shows daily fluctuations, more granular data is also available.

While this is just one element of the broader picture, it’s a crucial factor often overlooked by retail traders. For short-term pullbacks, key levels to monitor include the 1.4350 region, which has historically acted as significant support, and then subsequently the 1.42 level. A pullback to 1.42 would present a buying opportunity for US dollars, as the overall outlook suggests continued strength despite potential short-term overextension.

Federal funds futures are currently pricing in a 25 basis point rate cut by the Federal Reserve in May, with the next cut expected in December. This indicates a significant period before any substantial weakening of the US dollar. We can anticipate some pullback in the dollar’s strength during this timeframe.

The key question is whether we will see a daily close above the 1.45 level, which would suggest further depreciation of the Canadian dollar, or whether a pullback will occur, presenting a potential buying opportunity. While I favor the latter scenario, a breach above 1.45 would necessitate acknowledging the continued downward pressure on the Canadian dollar.

We hope you have enjoyed this USD/CAD analysis, for more regular analysis like this, tips for improving your trading and tutorials, be sure to check our education articles plus analysis and predictions.

If you want to trade forex? Here’s a list of forex brokers to check out.