Unlock the Multi-Trillion Dollar Forex Market: Find Your Perfect Broker. The forex market is a vast, multi-trillion dollar arena, presenting incredible profit potential. But with countless brokers vying for your attention, choosing the right one can feel overwhelming. Don’t worry – many brokers offer easy account setup for everyday investors. However, to truly capitalize on the opportunities, you need to consider key factors like regulation, fees, market access, powerful trading tools, flexible payment options, and reliable support. To simplify your journey, we’ve meticulously reviewed the top 3 forex brokers, giving you a head start on your path to trading success.

1. Capital.com: Top Forex Broker for New Traders – Only $20 to Start

Capital.com is a leading CFD broker, also offering spread betting and forex trading. They are a notable option for NASDAQ trading. Particularly suitable for beginners, Capital.com provides a user-friendly platform for easy order placement.

With Capital.com, you gain access to all major and minor currency pairs, plus a diverse range of exotic currencies. Trade any forex market you choose, all with leverage. Importantly, Capital.com boasts 0% commissions and highly competitive spreads, making it a top choice for traders seeking low-cost options. Get started with a free demo account after registration to explore the platform.

The demo account allows you to test your forex trading strategies without risk. As the Capital.com demo account replicates live market conditions, it’s an excellent way for beginners to learn. The minimum deposit to start trading with real funds is just $20, which is a minimal amount for most. The platform supports instant deposits via e-wallets and debit/credit cards.

Capital.com is also recognized as a leading AI trading broker. Its powerful AI system analyzes your trading behavior, monitors your market performance, and provides insights to help you make more informed trading decisions.

Capital.com is regulated by the FCA and CySEC, ensuring the safety of your funds. Beyond forex, the platform offers trading on a diverse range of assets, including ETFs, indices, precious metals, energies, and cryptocurrencies. Capital.com also provides access to over 2,000 stock CFDs from various global exchanges.

| Account minimum | $20 |

| Fees | Variable spread on Forex, Stocks & Crypto; Free of inactivity and withdrawal fees |

| Features | Low spreads, over 3,000 shares, spread betting & AI trading platform |

Pros & Cons

Pros

- 0% commission and tight spreads

- Thousands of markets on offer

- CFD asset classes include crypto, stocks, forex, and commodities

- Minimum deposit of just $20

- Supports debit/credit cards and e-wallets

- Great for beginners

- MT4 supported

- Leverage available – limits depend on your location

Cons

- You can’t invest in the underlying asset – CFD instruments only

2. AvaTrade: A Highly-Rated Forex Broker with MT4 & MT5

If you’ve already gained some experience in online forex trading, you may be looking for a more comprehensive platform. AvaTrade fits this bill, as it supports both the MT4 and MT5 trading platforms.

The MT4 and MT5 platforms offer an abundance of forex trading resources, including advanced order types, technical indicators, and chart drawing tools. AvaTrade users can then execute commission-free currency trades once linked to either platform.

Instead of commissions, AvaTrade charges a variable spread, which is often competitive, with EUR/USD spreads starting at 0.9 pips. In addition to forex, the platform offers CFDs on stocks, indices, and a range of cryptocurrencies. AvaTrade is also recognized as a leading Islamic forex broker.

AvaTrade ensures a safe trading environment, holding licenses across six jurisdictions, including from ASIC, the Central Bank of Ireland, and the FSA in Japan. You can start a live account with a minimum deposit of just $100, or explore the platform risk-free with their demo account. Quick and easy deposits can be made using debit and credit cards.

| Account minimum | £100 |

| Fees | Variable spread on CFDs & Forex; Commission of 0.25% for Bitcoin trading; $50 inactivity fee per quarter after three months of inactivity |

| Features | Supports MT4/5, commission-free platform, a wide range of tradable instruments, educational materials, islamic trading account, ASIC regulated |

Pros & Cons

Pros

- Regulated in 6 different jurisdictions

- Supports CFD markets on forex, stocks, cryptocurrencies, and more

- 0% commission and low spreads

- Compatible with MT4 and MT5

- Minimum deposit of just $100

- Leverage offered on all markets

Cons

- Stock CFD department is limited in comparison to other platforms

3. Go Markets: Forex Broker with MT4 and MT5, Plus High Leverage

GO Markets provides two account types: a commission-based option with spreads from 0 pips and a $3 per lot per side trading fee, and a spread-only account with spreads starting at 1.0 pips for major forex pairs.

GO Markets supports a wide range of base currencies, including USD, AUD, EUR, GBP, NZD, CAD, SGD, CHF, and HKD. Funding options include debit cards, credit cards, bank transfers, and e-wallets.

Rather than its own platform, GO Markets provides traders with the powerful MetaTrader 4 and 5 platforms. To further enhance trading, they offer Autochartist for automated technical analysis, daily forex signals, access to Myfxbook, and a VPS for algorithmic strategies.

| Account minimum | $200 |

| Fees | Variable spread on forex; commission account $3 per lot per side |

| Features | 49 currency pairs offered, leverage up to 500:1, spread-only account, MT4 & MT5, Autochartist |

Pros & Cons

Pros

- Trade 49 major and minor forex pairs through CFDs

- Apply leverage up to 500:1

- Spreads start from 0.0 pips with a commission account ($3 per lot per side)

- Includes MT4 and MT5

- Trading tools include Autochartist, Myfxbook, and a VPS

Cons

- Spreads are often slightly above average

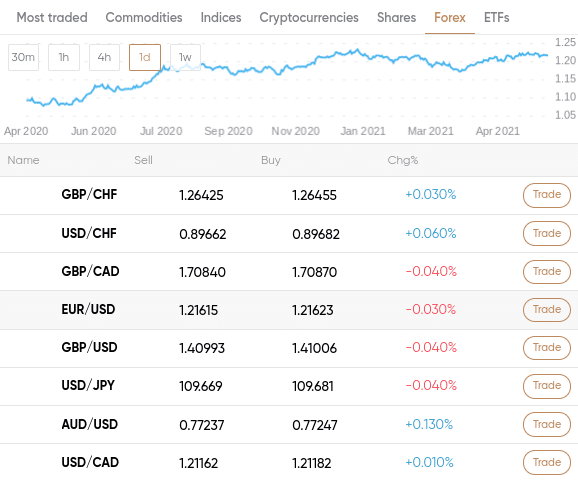

Brokers Comparison

The table below summarizes our forex broker reviews, outlining key factors such as commissions, minimum spreads, deposit fees, and maximum leverage available for retail clients.

| Forex Broker | Trading Commission | EUR/USD Spread (Min) | Deposit Fee | Max Leverage (Retail) |

| Capital.com | 0% | 0.8 Pips | FREE | 1:30 |

| Avatrade | 0% | 0.9 Pips | FREE | 1:30 |

| Go Markets | 0% | 1.0 Pips | FREE | 1:500 |

Please note that the leverage limits displayed in the table are not necessarily definitive. Depending on your country of residence, you may be eligible for higher leverage. You will be able to view your specific maximum leverage limit once you open an account with the forex broker.

FAQs

A forex broker is an online platform facilitating the buying and selling of currency pairs. After opening an account and making a deposit, you can use the broker to execute your trades, allowing you to participate in the forex market from anywhere.

Forex brokers generate revenue through various methods. Some brokers charge commissions on each trade executed by their clients. Additionally, they profit from the spread, which is the difference between the buying (ask) and selling (bid) price of a currency pair. Brokers may also impose fees on deposits and withdrawals.

For 2025, our analysis indicates that eToro stands out as the best overall forex broker. This highly regulated platform offers low fees and commissions, supports a wide range of payment methods, and provides access to numerous forex markets. Capital.com and Libertex are also strong contenders worth considering.

The spread in forex trading is the difference between the bid price (what you can sell a currency for) and the ask price (what you can buy it for). A larger spread indicates higher costs for accessing the market.

eToro is the top forex broker for traders looking to use PayPal for deposits and withdrawals.