Technical analysis in trading often boils down to two core approaches: range trading and breakout trading. Range traders look for opportunities within established price boundaries, while breakout traders aim to profit from significant price moves beyond those boundaries. But what happens when a breakout doesn’t hold? These “false breakouts,” or “fakeouts,” can present powerful trading opportunities if you know how to spot and react to them.

Understanding Range vs. Breakout Trading

- Range Traders: These traders operate within defined price levels of support and resistance. They buy near support and sell near resistance, anticipating the price will bounce within this range.

- Breakout Traders: They aim to capture momentum when a price breaks through a support or resistance level. They’ll typically sell when a price breaks below support and buy when it breaks above resistance, expecting the price to continue moving in that direction.

The False Breakout Phenomenon

The markets, however, are not always predictable. Many times, a price will briefly dip below support or rise above resistance, only to quickly reverse. This is a false breakout. It may not even make any long term trend. Instead, these quick swings are often influenced by other large players in the options market who manipulate the price for their own benefit. These battles can create sharp, volatile price action.

Why False Breakouts Occur

One significant explanation for false breakouts involves market dynamics, especially relating to options. Large players may push prices to trigger specific options contracts, such as barrier or double no touch options. When these strategies are complete, those forces may retreat, resulting in a rapid reversal of the initial breakout.

The resulting “fakeout” often triggers a sharp retracement in the opposite direction, which makes it useful for traders who know what to look for.

Example: The EUR/USD False Breakout

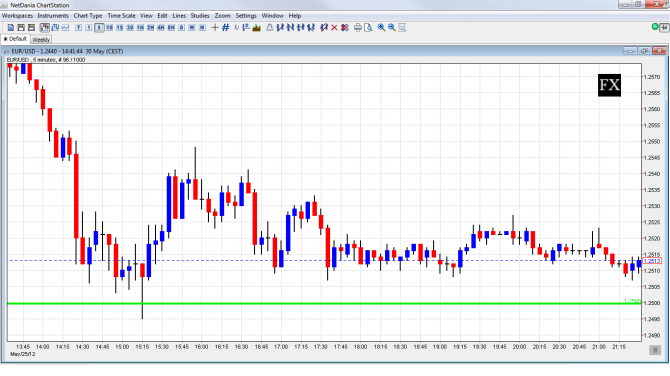

Let’s consider an example from May 25th, when the EUR/USD pair approached the 1.25 level. The price briefly dipped below this psychological support level, reaching 1.2495, before quickly rebounding. The subsequent move upwards took more time, but eventually rose to 1.2547. This initial drop was a false breakout. The brief downward push created a springboard for an upward rebound.

How to Trade False Breakouts

False breakouts can be a reliable source of income for traders if you use the following strategies:

- Extended Range Trading: Place an order in the opposite direction of the breakout just below support or just above resistance. This approach capitalizes on the immediate reversal after the fakeout. Think of it as a trade that is the inverse of the initial breakout.

- Stalk and Reverse: Instead of jumping on the initial breakout, watch the price carefully. If the breakout fails to hold, and the price begins to show signs of moving back into the range, take a position in the direction of range trading.

Conclusion

False breakouts, while initially frustrating for breakout traders, can be lucrative opportunities for those who understand their dynamics. By adapting strategies like “extended range trading” or “stalking and reversing,” traders can position themselves to profit from these deceptive price moves.

Do You Trade False Breakouts?

What are your experiences with false breakouts? How do you approach trading them? Share your thoughts in the comments below!

We hope you have enjoyed this article, for more articles like this, tips for improving your trading, be sure to check our education articles.

Want to trade forex? Here’s a list of forex brokers to check out plus analysis and predictions for major currencies.