For many new to Forex trading, the idea of leverage can seem intimidating, but it’s actually a crucial tool. Without it, trading would be very difficult, especially for individual traders. Leverage has been a part of finance for over a century, but it remains a concept that’s often misunderstood, even by some brokers and regulators. A common myth is that leverage increases risk, which simply isn’t true. The real key is understanding how to use leverage effectively in conjunction with proper risk management.

Understanding Leveraged Trading

Before you start trading with real money, it’s essential to understand the relationship between leverage and risk. Once you grasp this relationship, you can then safely trade with the maximum leverage your broker offers, which is often a good strategy when used wisely.

How Does Leverage Work?

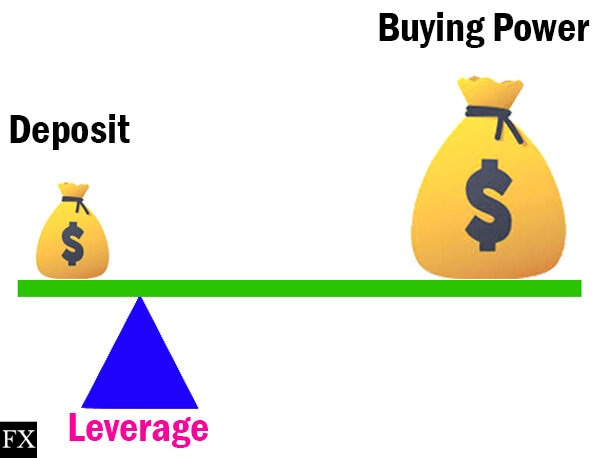

Leverage allows you to control a larger position in the market than your account balance would normally allow. It’s essentially borrowing capital from your broker. You’ll pay a small financing fee for this borrowed money, usually after the end of the trading day. Leverage is expressed as a ratio. For example, a 1:500 ratio means that for every $1 you have, you can control $500 in a trade.

Leverage allows you to control a larger position in the market than your account balance would normally allow. It’s essentially borrowing capital from your broker. You’ll pay a small financing fee for this borrowed money, usually after the end of the trading day. Leverage is expressed as a ratio. For example, a 1:500 ratio means that for every $1 you have, you can control $500 in a trade.

The Truth About Risk and Leverage

Here’s the crucial point: leverage itself doesn’t increase your risk. Risk is determined by your risk management strategy. Let’s say you have a $5,000 account and you decide you’re comfortable losing no more than 2% on any trade, which is $100. Whether you use 1:1 leverage or the maximum leverage available, your potential loss remains at that predetermined $100 – if you stick to your risk management plan. The problem arises when traders increase the size of their trades (lot size) without adjusting their risk management, leading to big losses. This is the result of poor risk management, not because of the leverage itself.

Therefore, before using leverage, it’s absolutely essential to understand how lot sizes impact your risk.

What Leverage is Best for a Beginner?

Surprisingly, the best leverage for a beginner is often the maximum available from your broker. This might sound counterintuitive, but here’s why: it forces you to focus on risk management, which is the cornerstone of any successful trading strategy. Once you understand how leverage interacts with risk management, you can safely trade with any level of leverage. It’s not about avoiding leverage, it’s about understanding it.

Pros and Cons of Leverage for Beginners

Here’s a breakdown of the positives and negatives of leverage:

Pros:

- Enables Retail Trading: Makes Forex accessible for smaller accounts.

- Flexibility: Provides greater control over positions.

- Increased Profit Potential: Can amplify gains when trades are successful.

Cons:

- Increased Loss Potential: Can magnify losses if trades go against you.

- Risk of Insufficient Capital: If you trade too large a lot size with not enough capital to cover that loss you can potentially loose all your money.

- Poor Risk Management: Can lead to large losses if risk management is ignored.

- Overtrading: Temptation to trade more frequently than you should.

- Lack of Education: Many beginners don’t fully grasp leverage.

- Misunderstanding of Leverage Impact: The biggest misconception is that leverage itself creates the risk rather than poor risk management.

Choosing the Right Leverage (and Why It Doesn’t Really Matter)

The right leverage is almost always the maximum offered by your broker. That is because risk is managed by you not your broker. Focus all of your efforts on setting up a good risk management strategy rather than the leverage being offered.

Tips to Avoid Common Leverage Mistakes

Here are some key tips to help you use leverage responsibly:

- Master the Leverage-Risk Relationship: Understand that risk is determined by your trading plan, not just the leverage you use. This is the single biggest mistake most traders make.

- Start with Sufficient Capital: It’s much easier to manage risk when you don’t have the threat of having all your money wiped out by one trade.

- Trade Appropriate Lot Sizes: Ensure your lot sizes align with your risk management plan, not your maximum leverage.

- Don’t Chase Losses: Never increase your risk to try and recover from a losing trade. Always stick to your predefined limits.

- Avoid Overnight Positions (When Possible): You pay fees on the borrowed funds overnight, and you run the risk of market shocks outside of trading hours.

The Bottom Line

Before you start trading with a high-leverage broker, take the time to understand risk management. Many resources on trading (even from brokers) will not tell you that risk management is the single most important thing to understand when it comes to trading. Leverage itself doesn’t increase risk; poor risk management does.

We hope you have enjoyed this article, for more tutorials and articles like this, tips for improving your trading and regular analysis, be sure to check our education articles.

Want to trade forex? Here’s a list of forex brokers to check out plus analysis and predictions for major currencies.