In the fast-paced world of forex trading, understanding currency pairs is fundamental. These pairs, like EUR/USD or GBP/JPY, represent the relationship between two currencies. But what exactly is the “base currency,” and why is it so important?

What is Base Currency?

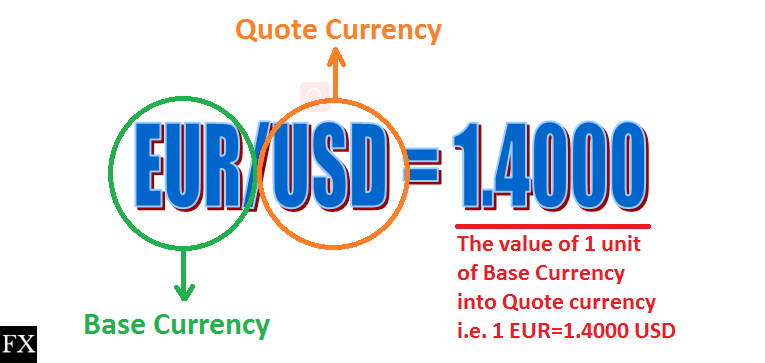

Forex traders identify the base currency as the first currency listed in a currency pair quote. It serves as the foundation upon which they build the exchange rate. The second currency, which follows the slash, is the “quote currency” or “counter currency.” For example, in the pair EUR/USD, the Euro (EUR) is the base currency, and the US dollar (USD) is the quote currency.

How to Read Currency Pairs

The exchange rate of a currency pair indicates how much of the quote currency the market requires to purchase one unit of the base currency. For instance, if the EUR/USD exchange rate is 1.10, then buyers need $1.10 to buy €1. Conversely, sellers of €1 would receive $1.10.

Examples of Base Currency in Action

Let’s imagine Sarah, who lives in the UK, wants to convert her British Pounds (GBP) into US Dollars (USD) for a trip to New York. She sees the exchange rate listed as USD/GBP = 1.25. Here’s how to interpret it:

- Base Currency: USD

- Quote Currency: GBP

- Meaning: This means that $1 is worth £1.25. In other words, Sarah would get $1 for every £1.25 she exchanges.

It’s important to understand that the currency being exchanged isn’t always the first currency. In Sarah’s case, she is trading her pounds for dollars, meaning GBP is the currency being traded, despite the quote being USD/GBP.

Common Currency Pairs

Several currency pairs are frequently traded in the forex market. These include:

- EUR/USD: Euro vs. US Dollar (One of the most liquid and heavily traded pairs).

- GBP/USD: British Pound vs. US Dollar

- AUD/USD: Australian Dollar vs. US Dollar

- USD/CAD: US Dollar vs. Canadian Dollar

- USD/JPY: US Dollar vs. Japanese Yen

In each of these, the first currency is the base currency, and the second is the quote currency.

Base Currency and Trading Decisions

Understanding base currency is crucial for making informed trading decisions. Here’s why:

- Trade Direction: When you “go long” or buy a currency pair, you are essentially betting that the base currency will appreciate in value against the quote currency. Conversely, if you “go short” or sell the pair, you believe the base currency will depreciate.

- Lot Sizes: Base currency often dictates the standard lot sizes used in trading. For example, a standard lot size for a USD-based currency pair is generally $100,000. If the base currency is not USD, the lot size is dependent on how much the currency is worth against the US dollar.

- Simultaneous Transactions: When you trade a currency pair, you are essentially buying one currency while simultaneously selling another. This is why currencies are always traded in pairs.

Key Takeaways

- The base currency is the first currency in a currency pair quote.

- The exchange rate indicates how much of the quote currency is needed to buy one unit of the base currency.

- Knowing the base currency is vital for understanding the direction of your trade, the lot size, and the simultaneous nature of currency transactions.

In Conclusion

Understanding base currency is a crucial first step for anyone venturing into the world of forex trading. By grasping the concept of currency pairs and how they relate to each other, you can make more informed decisions and potentially improve your chances of success in the dynamic forex market. This explanation should give you a solid foundation for further exploration.

We hope you have enjoyed this article, for more articles like this, tips for improving your trading, be sure to check our education articles.

Want to trade forex? Here’s a list of forex brokers to check out plus analysis and predictions for major currencies.