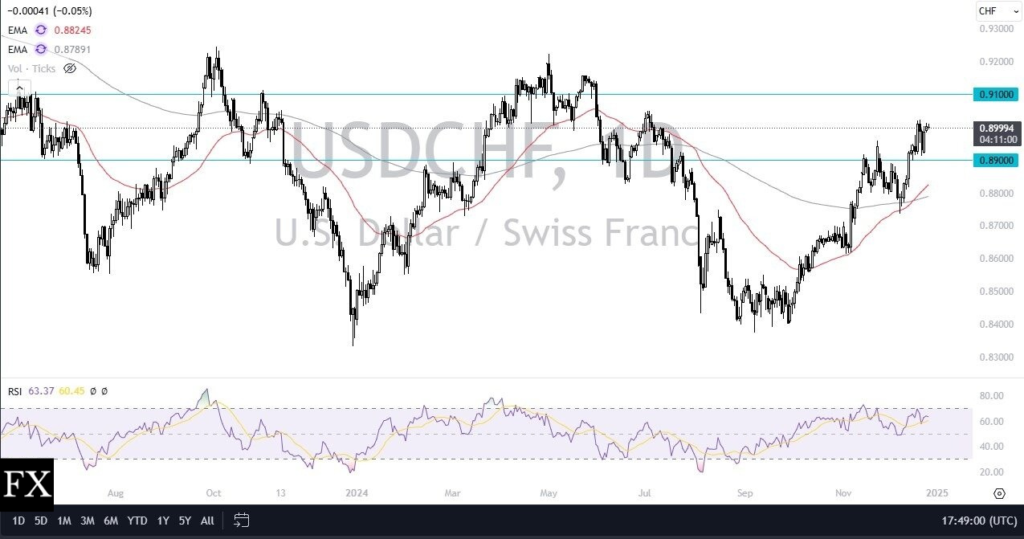

The USD/CHF pair is seeing slight gains, hovering around 0.8990 in early European trading Tuesday. The US dollar is finding support from expectations of sustained higher US interest rates. However, year-end trading volume is anticipated to be lighter.

The Federal Reserve’s projections signal fewer rate cuts than previously anticipated, which is bolstering the US Dollar. The “dot plot” now forecasts a 0.5% rate cut in 2025, down from the 1% projected in September, influencing market sentiment.

Recent US economic data reveals mixed results. New Home Sales saw a significant jump in November, rising 5.9% to an annual rate of 664,000. October’s figure was revised upward to 627,000 units. Conversely, Durable Goods Orders declined by 1.1% in November to $285.1 billion, falling short of expectations following October’s increase.

Meanwhile, traders are keenly observing rising geopolitical tensions in the Middle East, which could impact the Swiss Franc. As a safe-haven asset, the CHF could gain strength amid such uncertainty, potentially limiting upside for the USD/CHF pair. Recent reports indicate Israel’s actions against Hamas and warnings to Houthi rebels. Simultaneously, discussions are underway regarding a potential Gaza ceasefire, though a timeline remains uncertain.

Bonds & USD/CHF. Yes, Bonds.

The bond market is currently dictating market sentiment, and the markets are responding accordingly. Continued increases in US interest rates will likely strengthen the US dollar, with no indication of an imminent reversal. The Swiss National Bank, in contrast, maintains a dovish stance, evidenced by their recent 50 basis point rate cut, suggesting some apprehension. Consequently, pullbacks in this market are likely to attract buyers seeking cheap dollars. The Swiss franc is expected to depreciate further, although occasional downdrafts are possible. Overall, a long-term uptrend appears to be establishing.

Ready to trade our daily forex forecast? Here are the best online trading platforms to choose from.